Accelerated depreciation methods are one of the many ways you can take advantage of tax deductions. They’ll lower your taxable income and ultimately help you lower your tax bill year-over-year.

A capital asset is defined as property the taxpayer holds that is expected to generate value overtime. Over the course of its life it will lose value in a process called “depreciation.” These assets are not allowed to be expensed outright when they are purchased or acquired (except when applying certain accelerated methods, such as the section 179 deduction). Instead, they must be expensed gradually over their useful life. In other words, they must be depreciated until the “full deduction” of the property is reached or it’s disposed of.

The MACRS (Modified Accelerated Cost Recovery System) is the current depreciation system used in the United States. Under MACRS, there are a number of methods for depreciation. Here are the major ones:

- straight-line method

- double-declining balance method

- 150% declining balance method

The Straight-Line Method

The straight-line method, as the name suggests, is the most straight-forward and easy to understand. It is particularly used for real estate, including residential and commercial, which cannot used the accelerated declining balance methods.

Straight-line = Cost ÷ Useful Life

Let’s consider a residential real estate building costing a total of $700,000 to put in service. Under the standard MACRS useful life of 27.5 years, it’ll have an annual depreciation expense of $25,455 ($700,000 ÷ 27.5 = $25,455).

But what if you want to save on taxes with a bigger yearly depreciation deduction? What if you want to put money in your pocket now instead of postponing deductions into the future? Should you even want to deduct more now rather than in the future.

Why Even Employ A "Frontloading" Depreciation Deduction Strategy?

A simple answer to this last question is yes. You might want to put more money in your hands now than in the future. Central banks all over the world have been printing money at astronomical rates. It makes sense to figure ways to take as many deductions as you can now, when currencies are more valuable. If you wait, the expectation is that inflation (the loss of value of a currency because of an expansion of the money supply) will make those deductions in the future less valuable.

In turn, you can convert that more money now into assets that are better able to retain their value than paper- or centralized digital-currencies.

So how can you take a larger depreciation –more money now!– one way is the double-declining balance method.

The Double-Declining Balance Method

With the double-declining balance method you still expense the same dollar amount over the useful life of an asset. The difference is you do so in a way that is taking a heavier deduction now. Towards the end of the life of the asset it becomes less what you are able to expense from depreciation.

In simple terms, you are taking double the depreciation deduction that you would be allowed under the straight-line method, but the depreciation basis is lowered much more quickly than in the straight line method.

As we mentioned earlier, this is the way to go all other things considered, because of the obvious historical expectation of paper currencies losing their value over time.

Most assets representing tangible personal property, excluding real estate which is under the straight-line, are eligible for depreciation under this method.

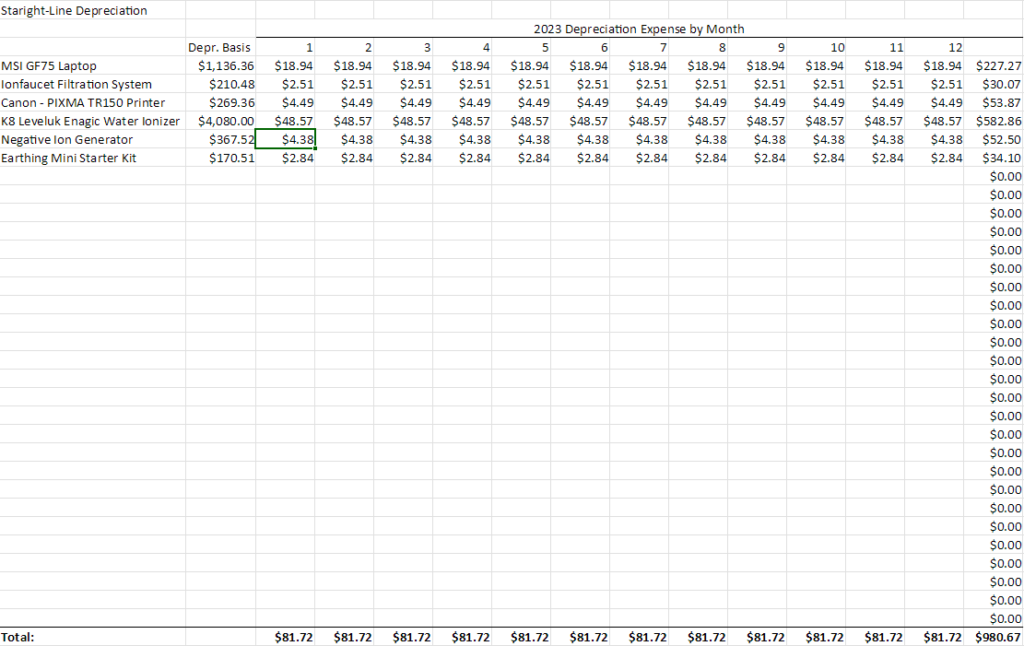

Example of the Straight-Line Method

Here’s an example of the double-declining balance method in action:

This is the depreciation schedule for one of our clients under the straight-line method and without regard to tax certain tax conventions. In a way you might say this is a pure business and bookkeeping approach to the depreciation of their office equipment. All of the items listed are under 5 and 7 year useful life consideration.

For example the K8 Leveluk Enagic Water Ionizer was put under a 7 year useful life.

$4,080 ÷ 7 = $582.86 yearly depreciation expense under straight-line depreciation.

$582.86 yearly depreciation ÷ 12 = $48.57 monthly depreciation expense.

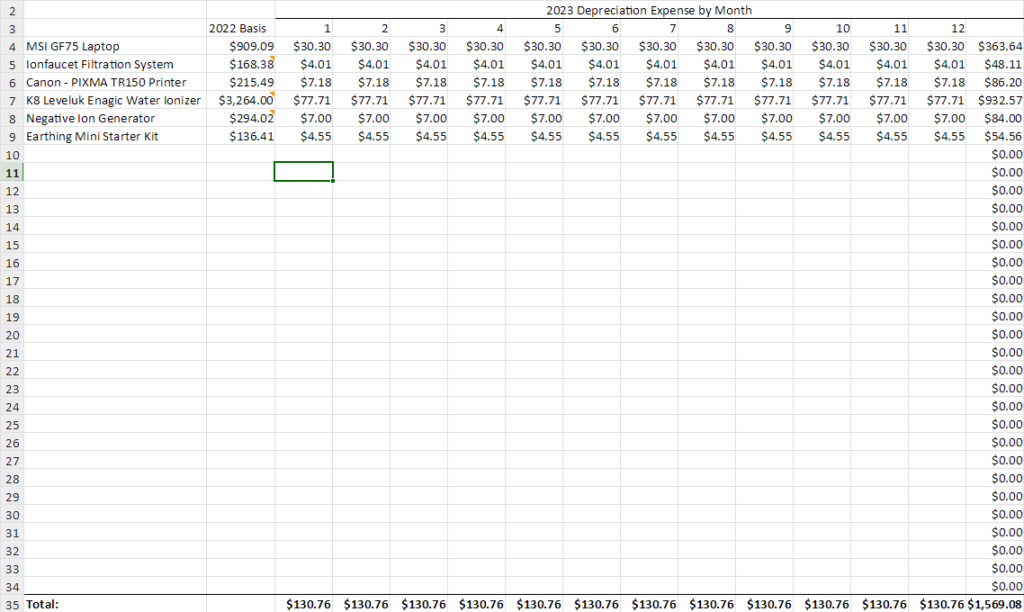

Example of The Double-Declining Balance Method

Now let’s take a look at how the double-declining balance method fares:

In this scenario we take 2÷7 = .28, then multiply that times our 2022 depreciation basis .28* 3,264 = 913.57. Finally, we divide it by 12 to get the monthly depreciation expense of $77.71. Dividing 7 – the number of years over which the asset is depreciated – by 2, makes it so that we’re taking 200% more of the depreciation over the remaining depreciation balance of the asset than we would otherwise do under the straight-line method.

What happens is we get to deduct $29.14 dollars per month more than with the straight-line method. We get a higher deduction now and lower deductions during the latter years of depreciation of the asset. This makes sense to do as business owners considering the declining value of paper and centralized digital currencies due to inflationary pressures and centralized banking practices.

Ask your accountant about the depreciation methods you’re currently using. You might find it makes sense to switch to the double-declining balance method or to take any section 179 deductions for any of your assets. We can do a free consultation for your overall bookkeeping situation and your depreciation to find out if there’s anything you can improve and get you more tax savings. Schedule a consultation or give us a call for more information.

Pingback: Tax-Free Investing. Is it Possible? - Odyssey Accounting