In this post we’ll answer the question: what’s the difference between an S-Corp and a C-Corp. We’ll also give you types as to which entity is better suited for your business. For more options for your business when it comes to entities to choose from, go here.

The Main Difference Between an S-Corp and a C-Corp

The main difference between an S-Corp and a C-Corp can be summed up in one sentence. The S-Corp is suitable for small businesses and the C-Corp is suitable for large businesses. I would go further and call the C-Corp more suitable for “Big Business.”

Most of the companies you see listed on the stock market were private C-Corps that became public. And so the two types, small business and big business, look to different business structures.

The reason for this is there are fundamental differences in how small and big business operate, their needs and objectives. Small business owners are typically not looking for a lot of capital or investors. On the other hand that’s how most big businesses start out. The C-Corp is ideally suited for getting funding from investors, whereas the S-Corp is limited to 100 total shareholders.

Pros and Cons of the C-Corp

One of the best Pros of the C-Corp is that you are not limited in the number of investors you can bring in. On top of that, they don’t need to be domestic, U.S.-based investors. That makes it easier to raise capital from multiple sources.

Another Pro of the C-Corp, is that there’s currently a flat tax rate for corporations, which is 21%. But remember, this is just the income tax charged to the corporation itself. When you take the money out to pay yourself as an individual through a dividend, you will incur more tax. This is the problem of double-taxation so often brought up about C-Corps.

You would think you’d save on taxes if individually you’re in a higher tax rate than 21% with the C-Corp. But you have to take into account the extra dividend tax you’d have to pay. Moreover, the effect of double-taxation most of the time will result in higher taxes than with other business structures.

The C-Corp's Double-Taxation Problem

In short, the corporation would first pay the 21% rate on their net income. Then, depending on your share in the company’s profits, you would get paid a dividend. Usually for closely held corporations the dividends would then be taxed at your long-term capital gains rate. These rates have 0%, 15% and 20% tax brackets depending on your level income.

Again, the C-Corp works well for people looking for some specified long-term exit strategies with the business. These could consist of selling the shares at an appreciated price to another investor later on. Another scenario is the sale of the business outright, where all or some of the shareholders get a return on their investment when they sell their shares to the buyer. And because these strategies can benefit from having low or no dividends taken out, double-taxation is less of a problem.

Pros and Cons of the S-Corp

The S-Corporation gets its name from Subchapter S of the Internal Revenue Code. It’s an election made to be taxed as a Small Business Corporation.

This election is made by filing Form 2553 with the IRS. You can start out as a C-Corp or an LLC, meet the requirements, file the form, and wait for IRS approval. If they approve you are then either a C-Corp or LLC electing to be taxed as an S-Corporation.

The main Pros of the S-Corp lie with its simplicity and tax breaks.

On the simplicity front, the S-Corp is a pass-through tax entity. This means essentially that the S-Corp pays no taxes itself. Instead, the shareholder’s allocation of profits “passes-through” to their personal tax return.

This simplicity in itself leads to a tax break. Ultimately, it avoids corporate double taxation, as we saw with the C-corporation. With a normal corporation you pay taxes twice, once as the corporation and another as the individual. But with the S-Corp, you only pay taxes on the individual level.

Yet with all of this is mind, there’s yet another tax advantage to the S-Corp: less self-employment taxes.

The S-Corp and Self-Employment Taxes

Remember when you got Social Security and Medicare tax taken out of your check you were a W-2 employee? If you recall, those two combined took 7.65% of your check. That’s called the employee side of payroll taxes. And your employer contributed the other half of another 7.65% of the payroll taxes.

Well, now that you decided to start your own business, you’re still responsible for these payroll taxes (also known as FICA taxes). But this time, you not only owe the employee side of it (7.65%) but also the employer side (7.65%). That’s a whopping total of 15.3% tax on your business’ net income as a self-employed person. Keep in mind that this is in addition to income taxes.

The S-Corp can really be of benefit here, since its net income is not subject to self-employment taxes. But you as the owner of your business must pay yourself a reasonable salary through payroll. Since you’re both the employer and the employee in this case, you would pay the full 15.3% of what you pay yourself through payroll.

The Cons of the S-Corp

No discussion of the S-Corp would be complete without considering its Cons. S-Corps lack flexibility in that distributions taken must be equally based on shareholder percentage. What this means is you must be mindful of each shareholder’s percentage when taking out profits from the business. This differs from LLC partnerships where profits can be taken out disproportionately, as long as the operating agreement isn’t being violated.

Another disadvantage is that S-Corp election can be disqualified by the IRS. If you brake any of the rules the IRS can disqualify your S-Corp and at that point you would be taxed again as an LLC or C-Corp (depending on how you started the company).

Some may consider some of the S-Corp rules to be disadvantageous also. There cannot be more than 100 shareholders. There can only be one class of stock. Individual shareholders must be either U.S. citizens or permanent residents of the U.S. Also, shareholders must take a reasonable salary based on their work performed based on similar positions in similar businesses. All these could be reasons for the IRS to take away your election, or reclassify your income to pay for insufficiencies of self-employment taxes.

Tax Savings LLC Partnership vs. S-Corp vs. C-Corp

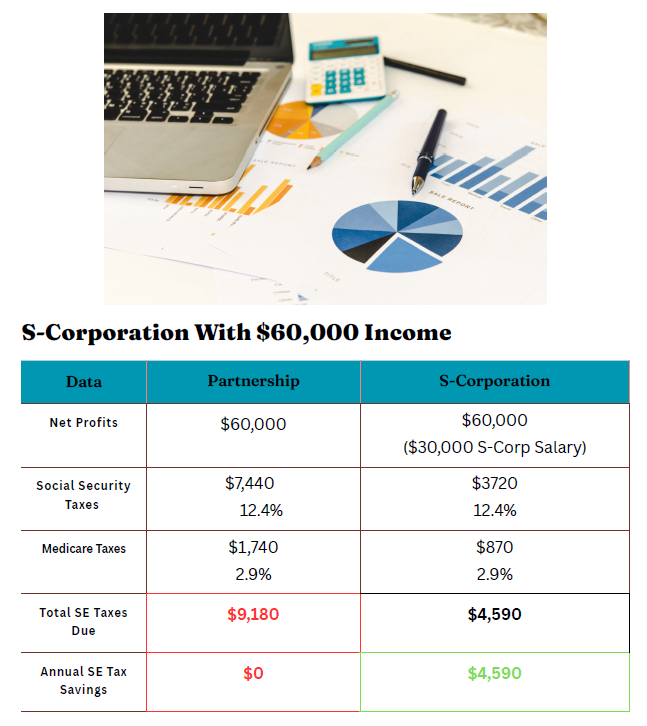

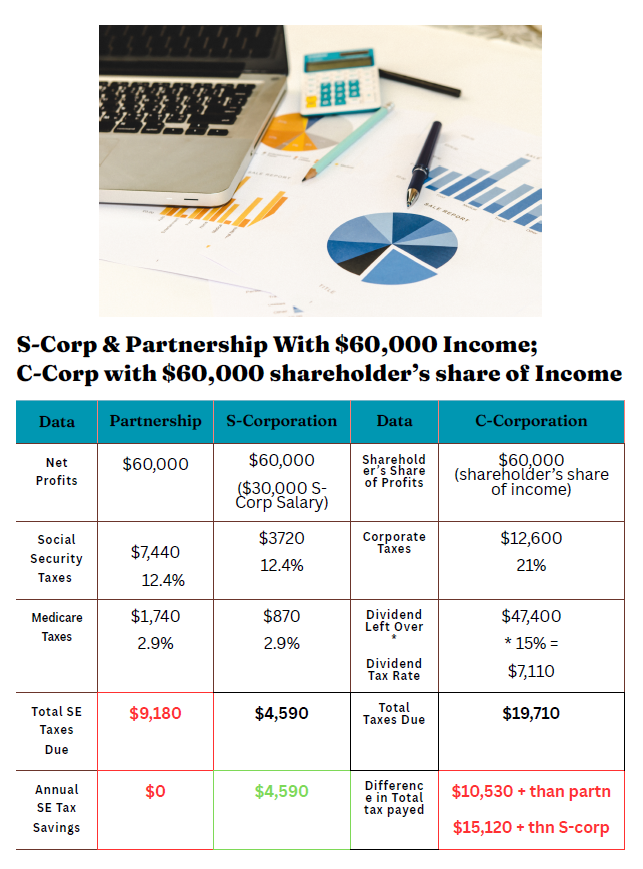

In this example, we take an LLC Partnership, an S-Corp, and a C-Corp. Let’s see how they fare with $60,000 in net profits or shareholder’s share of profits.

The LLC Partnership (we would have the same result with an LLC sole-proprietor) takes the full brunt of Self-Employment taxes. That’s 15.3% taxes to the LLC’s net income. We get a total of $9,180 to pay in self-employment taxes.

When you take the S-Corp, let’s say you pay yourself a reasonable salary of $30,000. Self-employment taxes are cut in half, to $4,590. That’s a total savings of $4,590 when compared to the LLC partnership.

See the comparison chart below.

Now let’s look at a C-corporation.

We start out with a share of income of $60,000 to the shareholder. We get charged the flat corporate tax rate of 21%. That’s $12,600 in tax. Now we’re left over with $47,400 after the tax. But that money is still within the corporation. We haven’t paid ourself that yet. So we take the $47,400 as a dividend. Let’s assume that your in the middle 15% dividend tax rate (same as long-term capital gain rate). That would make for another $7,110 in tax. And that comes up to a whopping $19,710 in total tax. That’s $10,530 more in tax than the partnership and $15,120 more in tax than the S-Corp.

Conclusion

In this article, we outlined the major differences between the S-Corp and C-Corp. We saw the problems with C-Corp double taxation; we also considered the strategies and scenarios that would make a C-Corp desirable. Then, we considered the pros and cons of the S-Corp. Finally, we broke down the tax benefits that S-Corp affords small business owners.

For information on single-member and partnership LLCs, go to this article. If you’d like to see a video explanation of the tax advantages of the S-Corp, click here.