You’ve made a 50% ROI over a two year period on your stock portfolio and sold to realize your profits. Good for you! You’ve done a great job and you put in the work in your research! But what about taxes on investment returns?

One consideration we often don’t go into is the fact that pre-tax and after-tax returns are important factors to consider and might even play a big role in determining how your overall investment portfolio will look like for maximum growth potential.

Let’s say you invested $20,000 and made a $10,000 gain over two years. With a ~20% long-term capital gains rate for federal and state combined, your gain will end up at $8,000 after tax. That means that your 50% pre-tax ROI will become a 40% after-tax ROI.

If you start to analyze your investment portfolio across asset classes that will give you a better perspective on where to invest and what strategy are you going to ultimately go for: will it be for maximum growth, adequate diversification, a highly defensive no-leverage low-risk, or even something favoring the best tax-advantages?

Compounding Investment With and Without Tax

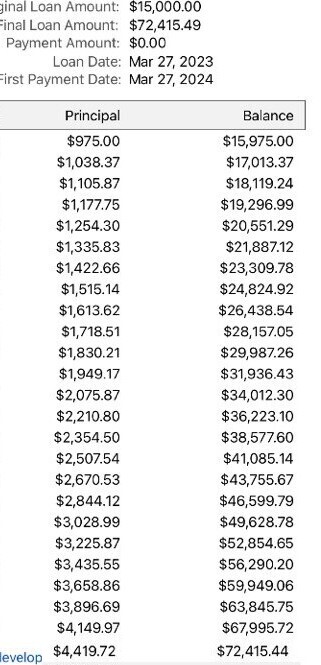

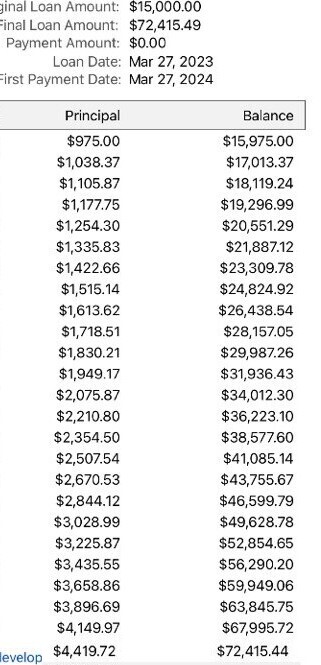

Let’s take a $15,000 dollar start to our investing and assume a 10% growth year over year over 25 years. Let’s assume a 35% overall tax rate being applied in this scenario and see where we would fare over the 25 years.

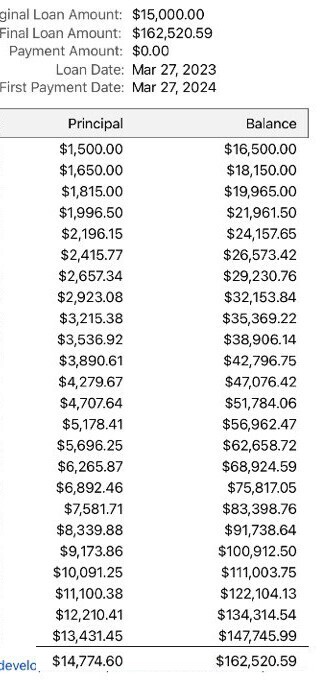

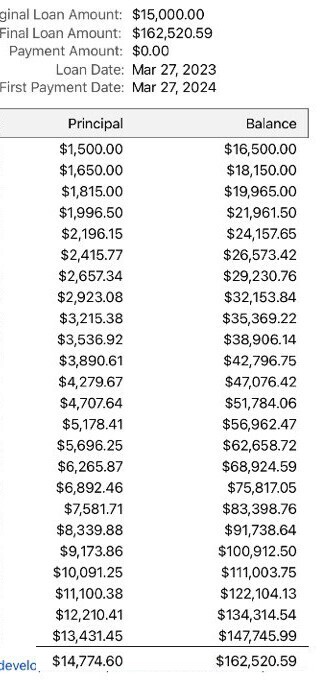

Now let’s take the same $15,000 start to our investing but assume we will invest it in such a way that we will avoid the taxes and pay zero tax (don’t worry! we will post more articles on the subject and post link them here when they’re published). We will still experience a 10% growth but without the tax bite.

Here are both scenarios side by side for comparison:

From $72,415 with 35% tax to $162,520 with tax free growth, that’s more than double than the first scenario!

So mind before and after tax returns. It can make a huge difference! Check out this article where we explore a strategy in which you can invest tax free.

Pingback: Tax-Free Investing. Is it Possible? - Odyssey Accounting