If you’re wondering how to get a juicy meals deduction for 2022, read on. We will also consider what the tax year 2023 will be like on this matter.

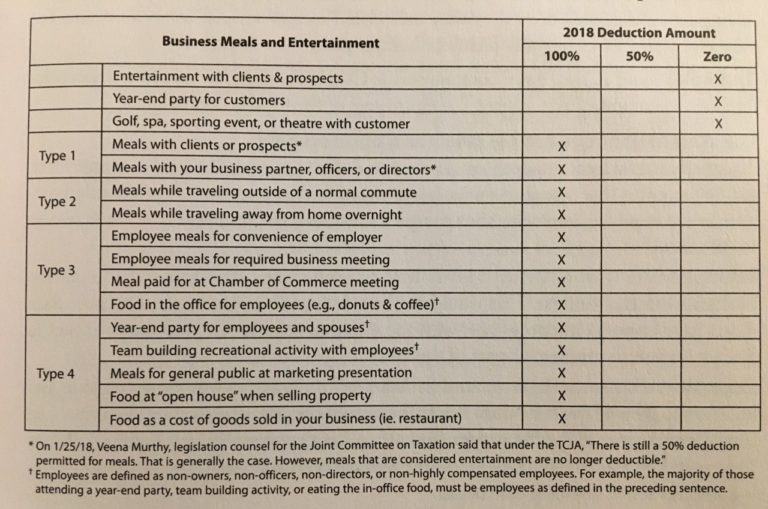

With the Tax Cuts and Jobs Act coming into effect in 2018, there were some key changes for meals. Before 2018, the category “Meals & Entertainment” was seen as a common category by accountants. The reason is that both meals and entertainment expenses were 50% deductible by businesses. That all changed in 2018.

Entertainment expenses, meaning entertainment for clients and prospects were deemed non-deductible. That only leaves room in this discussion for the deductibility of meals (although we’ll look at some exceptions too in a future article!)

The 100% deduction for Meals

Most meals that qualify as deductible started to be 100% deductible with the 2020 Cares Act. That goes for tax years 2021 and 2022. In 2018 through 2020, there was a 50% deductibility of qualifying meals as per the Tax Cuts and Jobs Act. And in tax year 2023, meals will revert back to the 50% deductibility standard.

The key idea to consider is that “business meals”, but not personal or entertainment meals are deductible. This means that meals had with clients, prospects, and business partners might qualify, but not with non-business related interactions.

In order for business meals to be deductible, they must be ordinary and necessary for the operation and success of the business. Business must be discussed during, after, or before the meal among the individuals involved.

For 2021 and 2022, you can deduct 100% of the meal as long as there’s a business purpose AND you’ve purchased your meal from a restaurant or a caterer. The same goes for business travel meals except those that would count as “on-the road” expenses, which are only 50% deductible. For more on travel deduction rules, go to this article.

TAX SAVINGS IDEA: If you want to take more of a meals deduction for 2022, include meals in your strategy. If your spouse or an associate you typically have meals with is also your business partner, talk business while eating. Recording the details of who, where, when, why, the cost, in a timely manner will work to audit-proof your deduction.1

Requirements for Deductibility of Meals

The IRS requires that meals must be had in an environment conducive to business. That means that meals had at a loud venue with entertainment shows going on will not qualify. Nightclubs and theaters will likely not be eligible (except it is conducive to business conversations).3

Even though receipts for meals have not been required for those under $75,4 it’s a good idea to keep them regardless. According to IRS insider Sandy Botkin, this is because “IRS agents love seeing receipts, and it will avoid most problems.”5

A further requirement is that you must adequately document your meals deduction for 2022 or any other applicable year. One way to do this is to have a tax organizer. This can be a physical book or an app were you input all the information required for your business meals.

Another method is to use a simple notebook and even better to relay this information to your bookkeeper on a regular basis. That way she can record the details of your meals within your bookkeeping software. This gives additional documentation that will make it less likely that your business will be affected adversely by an audit.

What to Include in Documentation for Business Meals

- Info regarding who participated in the meal. Including names, occupation, and other characteristics that will help relate him to your business operations.

- The exact time and place that the meal happened.

- The cost of the meal and nature of the meal. Was the meal for lunch, happy-hour, or dinner? Was it just coffee, soft drinks, or full-scale meal?

- The business purpose of the meal. Link the event to how it relates to your business and how it will promote business profits. A description could be something like “exchanged referrals,” or “discussed potential partnership opportunities.”

2023 50% Meals Deduction Exceptions

As noted earlier, 2023 and on (for the time being) will revert to the 50% meals deduction convention. However, there are some exceptions to this rule were 100% deductibility will still apply.

Events and celebrations held for employees are 100% deductible. Marketing and promotional events will also be 100% deductible, including meals. Other marketing and sales oriented events, such as seminars, fall under the same category.

If you’re a real estate agent hosting open houses, you’re in luck as this type of events are 100% deductible. That also goes for travel agents who are having travel meals and events associated with their trade.7 (As a brief aside, for the rest of us, travel meals are only 50% deductible when on business days of travel! Check out this article for more on understanding business travel deductions)

That goes without saying that you should always document your meals expenses and in this case, the events and entertainment expenses.

The Home Entertainment Expense Deduction

As Botkin suggests, a good way to escape having to have one-on-one business convo’s with all the guests is to have promotional displays on the wall, as well as a formal business-reason invitation for the guests.8 The point is to make sure you’re having multiple ways to demonstrate to the IRS the business purpose of your home event.

Conclusion

In closing, take advantage to take the biggest meals deduction for 2022, since qualified meals are 100% deductible. Also keep documenting everything and following protocol for the 2023 tax year, since you’ll still be allowed 50%. Be mindful of the exceptions where a 100% deduction applies and above all, work with your advisors on this for maximum savings.

Contact us for help with your ongoing bookkeeping, payroll management, and tax planning and tax prep for end-of year. In short, we serve as your outsourced accountant and advisor year-round, saving you thousands on staffing and potential tax savings. Set up a one-to-one call with us by filling out a form here.

References

1. Section 1.274-5T(c), Income Tax Regulations, from here ITR.

2. Botkin, Sandy. Lower Your Taxes – Big Time! McGraw Hill, 2023, pp. 9.

3. Section 1.272-2(c)(7), ITR.

4. Section 1.272-5(c), ITR.

5. Botkin, Sandy. Lower Your Taxes – Big Time! McGraw Hill, 2023, pp. 9.

6. Section 1.274-5T(c), ITR.

7. Section 274, IRC.

8. Botkin, Sandy. Lower Your Taxes – Big Time! McGraw Hill, 2023, pp. 15-16.

Pingback: A Home-Based Business Could Save You in Taxes