We now go to France to continue our series on money experiments in history. As usual we’ll be relying on Michael Maloney’s book Guide To Investing in Gold & Silver.1 For more articles on precious metals investing, please go to our blog posts page by clicking here. For the previous article in this series, please click here.

John Law was the son of a Scottish goldsmith and banker. He had had his troubles with the law before getting into money manipulation schemes in France. He was also an avid gambler and ladies’ man who escaped prison after getting into a duel over a woman.

Louis XIV Debt Crisis

France’s debt was mounting under Lois XIV due to his ongoing wars and the excesses of his royal lifestyle. After escaping from prison, John Law has landed in Paris and made the acquaintance of the Duke d’Orleans. Being part of the royal family, he was placed as the regent of France after the death of Louis XIV.

“…[T]o his horror he found out that France was so deep in debt that taxes didn’t even cover the interest… Law, sensing opportunity, showed up at the royal court with two papers for [the Duke d’Orleans] blaming the problems of France on insufficient currency and expounding the virtues of paper currency. On May 15, 1716, John Law was given a bank (Banque Générale) and the right to issue paper currency…”2

Paper Currency and Paper Share Madness

Law started to print paper money and put it into circulation. As a result the French economy was spurred out of its stagnation and soon, Law was being touted as a financial wizard.

The Duke d’Orleans rewarded him by giving him the exclusive rights to the trade within the Louisiana Territory in America. Consequently Law founded the Mississippi Company to trade in these vast new territories. Thereafter, the Mississippi Company became the number one company in all of France.

With the newly found success of his company, Law issued 200,000 new shares to sell to the public. Hinging on the popularity of Law and his company, the stock price exploded to more than 30 times in a manner of months.

John Law is Rewarded

Seeing how well things were going for Law and his investors, the Duke d’Orleans again rewarded him. He gave him the monopoly on tobacco and the exclusive rights to refine and mint gold and silver. He also made Law’s bank the royal bank of France.

As the royal (central) bank of France, Law’s paper currency was seen as being backed by the French government. Thus the French government went from being mired in problems and debt to an illusory prosperity. By using paper currency printed from nothing, it managed to service its debt, spend lavishly and escape its financial troubles.

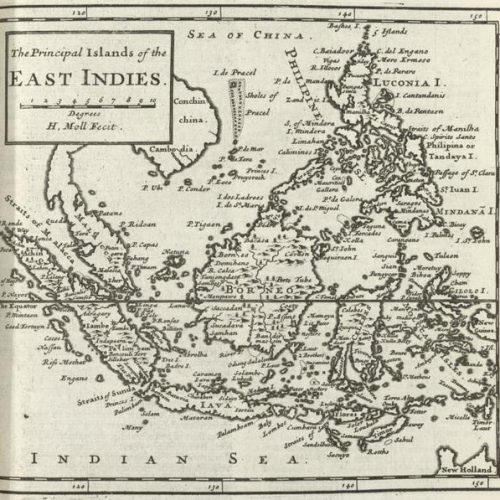

The Duke rewarded John Law once again by granting the Mississippi Company the exclusive trade rights for China, the East Indies, and the South Seas. When he heard this, Law issued more shares for his company, a total of 50,000 more shares. He had 300,000 applications for the purchase of shares in his company, including dukes, duchesses, marquises, and counts. To solve this problem, Law decided to issue 300,000 instead of the 50,000 he initially issued.

It All Comes Crashing Down

But the milk and honey had to run out eventually. Soon after Law had been given the Bank Générale, the effects of inflation started to be felt. The value of real estate and rents in Paris saw a jump in a multiple of 20!

People began to wake up to the illusion of paper currency and converting it fast. “People started converting their notes to coin, and bought anything of transportable value. Jewelry, silverware, gemstones, and coin were bought and sent abroad or hoarded.”3

In 1720 the banks discontinued paper note redemption for gold and silver. It was also made illegal to transact in gold and silver and to purchase jewelry, gems and silverware.

On May 27 of 1720, the banks closed and paper notes were devalued by 50%. “…[O]n June 10 the banks reopened and resumed redemption of the notes for gold at the new value. When gold ran out, people were payed in silver. When silver ran out, people were payed in copper. As you can imagine, the frenzy to convert paper back to coin was so intense that near riot conditions ensued. Gold and silver had delivered a knockout blow.”4

Needless to say, the Mississippi Company collapsed, along with the shareholders that hadn’t gotten out in time. Another lesson from history that we might learn from today. Can you see any similarities to our current situation?

References:

1. Maloney, Michael. Guide to Investing In Gold & Silver. Scottsdale, RDA Press 2015.

2. Ibid. 13.

3. Ibid. 15.

4. Ibid. 15.

Wow, wonderful blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is great, as well as the content!

Thanks very much! Been blogging for only about 3 years.